Looking for affordable car insurance as a student? Look no further! State Farm car insurance quote for students offers great coverage options tailored to your needs. Buckle up as we dive into the world of student car insurance with State Farm.

From specific coverage options to eligibility criteria, we’ve got you covered with all the essential information you need to know.

Overview of State Farm car insurance for students: State Farm Car Insurance Quote For Students

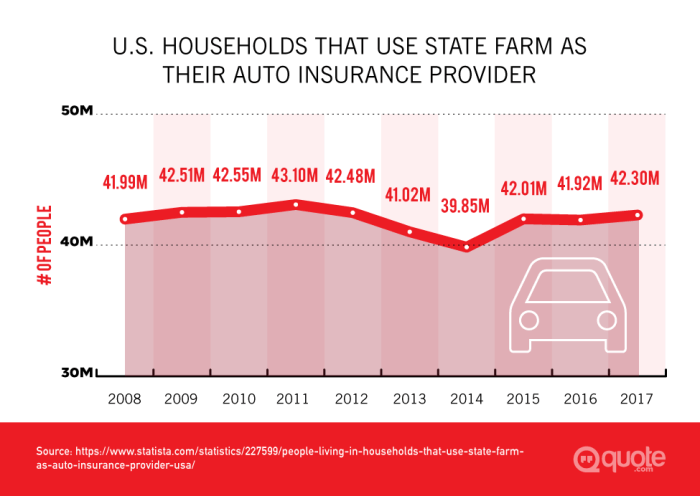

Car insurance is essential for students who drive regularly to school, work, or other activities. State Farm offers specific coverage options tailored to meet the needs of student drivers, providing peace of mind and financial protection in case of accidents or unforeseen events.

Specific Coverage Options

- Liability Coverage: Protects students from financial responsibility in case they are at fault in an accident.

- Collision Coverage: Covers the cost of repairs or replacement of the student’s vehicle in case of a collision.

- Comprehensive Coverage: Provides coverage for damages not caused by a collision, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: Protects students in case they are involved in an accident with a driver who has insufficient insurance coverage.

Benefits of Choosing State Farm

- Student Discounts: State Farm offers discounts specifically for students, helping them save money on their car insurance premiums.

- 24/7 Customer Support: Students can access State Farm’s customer service team at any time, providing assistance and support when needed.

- Mobile App: State Farm’s mobile app allows students to manage their policies, file claims, and access important documents easily from their smartphones.

- Roadside Assistance: State Farm offers roadside assistance coverage, providing students with help in case of a breakdown or emergency while on the road.

Eligibility criteria for students to get a State Farm car insurance quote

To be eligible to receive a State Farm car insurance quote as a student, there are specific requirements that need to be met. State Farm offers special discounts and perks for student policyholders, making it an attractive option for those still in school.

Requirements for Student Quotes

- Must be enrolled full-time in a college or university

- Under the age of 25

- Have a good academic standing (usually a minimum GPA requirement)

- Hold a valid driver’s license

Special Discounts and Perks

- Good Student Discount: Students who maintain a high GPA may qualify for a discount on their car insurance premium.

- Driver Training Discount: Completing a driver education course can also lead to savings on insurance costs.

- Low Mileage Discount: If a student doesn’t drive long distances regularly, they may be eligible for a discount.

Comparison with Regular Quotes

Students have the advantage of accessing discounts and perks tailored to their unique situations, which may not be available to regular policyholders. These special offers make State Farm a popular choice for students looking to save on car insurance while still receiving quality coverage.

Process of obtaining a State Farm car insurance quote for students

Obtaining a car insurance quote from State Farm as a student is a straightforward process that can be completed online or through an agent. Here are the steps involved in requesting a quote and some tips to help students get the most accurate quote possible.

Hey there, ready to conquer the digital world? Check out this awesome guide on Hello world! to kickstart your journey into the exciting realm of programming!

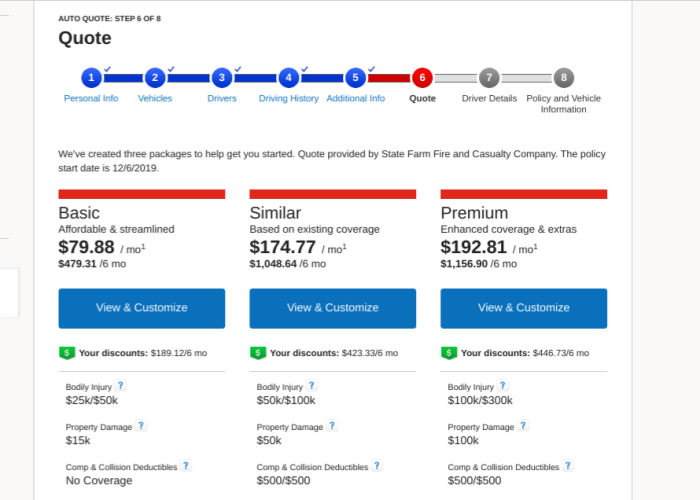

Requesting a Quote

- Visit the State Farm website or contact a local agent to initiate the quote request process.

- Provide all the necessary information about yourself, your vehicle, driving history, and any other relevant details requested.

- Choose the coverage options that best suit your needs and budget.

- Review the quote provided, ask any questions you may have, and make adjustments if needed.

- Finalize the quote and complete the required paperwork to activate your car insurance policy.

Tips for Accuracy

- Be honest and accurate when providing information about your driving history and vehicle details to ensure the most precise quote.

- Consider bundling your car insurance with other policies, such as renters or homeowners insurance, to potentially qualify for discounts.

- Ask about available discounts for students, good grades, safe driving, or completing a defensive driving course to lower your premium.

Online Tools and Resources

- State Farm offers online tools like the Quote Calculator, which allows you to input your information and get an estimated quote instantly.

- Utilize the online chat feature or contact a State Farm agent through the website for personalized assistance and guidance during the quote process.

Factors influencing the cost of State Farm car insurance quotes for students

When it comes to determining the cost of car insurance for students, there are several key factors that come into play. These factors can significantly impact the price of insurance quotes for student drivers. Understanding these factors can help students make informed decisions and potentially lower their insurance costs.

Driving Record

A student’s driving record is one of the most influential factors when it comes to determining the cost of car insurance. A clean driving record with no accidents or traffic violations will typically result in lower insurance premiums. On the other hand, a history of accidents or traffic tickets can lead to higher insurance costs due to the perceived higher risk associated with the driver.

Type of Vehicle

The type of vehicle that a student drives can also impact the cost of car insurance. Vehicles that are considered safer, more reliable, and less expensive to repair or replace generally have lower insurance premiums. On the other hand, sports cars, luxury vehicles, or vehicles with high theft rates may result in higher insurance costs.

Location, State Farm car insurance quote for students

Where a student lives and drives can also influence the cost of car insurance. Urban areas with higher traffic congestion and crime rates generally have higher insurance premiums compared to rural areas. Additionally, students living in areas prone to natural disasters or severe weather conditions may also face higher insurance costs.

Hey there, curious minds! Have you ever wondered about the origins of the famous phrase “Hello world!”? Well, Hello world! is actually a common phrase used in computer programming to introduce beginners to a new programming language. It’s like a warm welcome to the coding world!

Coverage Options

The coverage options selected by students can also impact the cost of car insurance quotes. Opting for comprehensive coverage, higher liability limits, or additional coverage options will result in higher premiums. On the other hand, choosing basic coverage with lower limits can help students save on insurance costs.

Driving Habits

Students who drive frequently or for long distances may face higher insurance costs compared to those who drive less often. Insurance companies consider mileage, driving habits, and the purpose of the vehicle when calculating insurance premiums. Students who can demonstrate safe driving habits and low mileage may be eligible for discounts or lower rates.

Last Word

Ready to hit the road with the right coverage? State Farm car insurance quote for students has you covered. Make sure you’re protected on your journeys with the perfect policy that fits your student lifestyle. Stay safe out there!

Commonly Asked Questions

What discounts are available for student policyholders?

State Farm offers special discounts for students, such as good student discounts and safe driving discounts. Be sure to inquire about all available options!

How can students lower their insurance costs?

Students can potentially lower their insurance costs by maintaining a good driving record, opting for higher deductibles, and taking advantage of available discounts.

What factors impact the cost of insurance for student drivers?

Factors such as driving record, type of vehicle, location, and coverage options can all influence the cost of car insurance for student drivers.