Geico car insurance quote calculator lets you crunch the numbers and unlock potential savings. Dive into the world of insurance quotes with just a few clicks, and discover how easy it is to find the best deal for your car insurance needs.

Overview of Geico Car Insurance Quote Calculator

When using the Geico car insurance quote calculator, individuals can easily obtain an estimate of how much their car insurance premium might cost. This tool works by taking into account various factors such as the driver’s age, location, driving history, type of vehicle, coverage options, and more.

How It Works

- The user inputs specific details about themselves and their vehicle into the calculator.

- The calculator then uses algorithms to analyze the data and provide an estimated insurance premium.

- Users can adjust different variables to see how they affect the quote, allowing for customization.

Information Required

- Driver’s personal information (age, gender, address)

- Vehicle details (make, model, year)

- Driving history (accidents, violations)

- Desired coverage options (liability, comprehensive, collision)

Accuracy and Reliability

- The quotes generated by the Geico car insurance quote calculator are generally accurate and reliable.

- However, it’s important to note that these are estimates and the final premium may vary based on additional factors not considered in the calculator.

- Users can contact Geico directly for a more precise quote based on their specific circumstances.

Factors Considered in Geico Car Insurance Quote Calculation

When it comes to calculating car insurance quotes, Geico takes into consideration various factors that can significantly impact the final cost. Let’s delve into the key elements that influence the calculation of car insurance quotes by Geico.

Age

Age plays a crucial role in determining car insurance premiums. Generally, younger drivers under the age of 25 are considered higher risk due to their lack of driving experience. As a result, they may receive higher insurance quotes compared to older, more experienced drivers.

Location

Your location can also influence your car insurance quote. Urban areas with higher traffic congestion and crime rates may lead to higher premiums compared to rural areas with lower risk factors. Additionally, state regulations and requirements can impact insurance costs.

Driving History

Your driving history, including any past accidents, traffic violations, and claims, can have a direct impact on your insurance quote. A clean driving record with no accidents or violations will likely result in a lower premium, while a history of incidents may lead to higher costs.

Vehicle Type

The type of vehicle you drive can affect your insurance quote as well. Factors such as the make and model of your car, its age, safety features, and likelihood of theft or damage all play a role in determining your premium.

Expensive or high-performance vehicles may result in higher insurance costs.

Discounts and Special Considerations

Geico offers various discounts and special considerations that can help lower your insurance premium. These may include discounts for safe driving, bundling multiple policies, having anti-theft devices, being a good student, or being a member of certain organizations. Additionally, factors like your credit score and annual mileage may also be taken into account during the quote calculation process.

User Experience with Geico Car Insurance Quote Calculator

When it comes to the user experience with Geico’s car insurance quote calculator, many users have reported positive feedback. The calculator is known for its ease of use, speed in obtaining quotes, and overall satisfaction among customers. Let’s dive into some specific aspects of the user experience below.

Ease of Use

- Users find Geico’s car insurance quote calculator to be extremely user-friendly and intuitive.

- The interface is clean and straightforward, making it easy for users to input their information and receive accurate quotes.

- Customers appreciate the simplicity of the tool, as it eliminates the need for complicated calculations or confusing terminology.

Speed of Obtaining Quotes

- One of the standout features of Geico’s calculator is the speed at which users can obtain quotes.

- Customers have reported receiving instant quotes, allowing them to make quick decisions about their car insurance needs.

- The efficiency of the calculator saves users time and ensures a seamless experience from start to finish.

Overall Satisfaction

- Overall, users have expressed high levels of satisfaction with Geico’s car insurance quote calculator.

- The accuracy of the quotes, combined with the ease of use and speed of the tool, contributes to a positive user experience.

- Many customers have praised Geico for providing a reliable and efficient way to obtain car insurance quotes online.

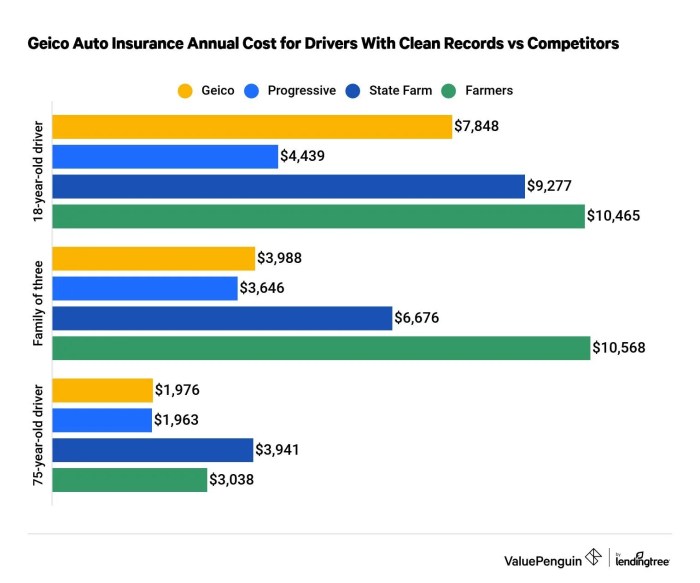

Comparison with Other Insurance Providers

- When compared to other insurance providers, Geico’s car insurance quote calculator stands out for its user-friendly interface and speed in delivering quotes.

- Customers appreciate the seamless experience provided by Geico’s calculator, especially when contrasted with more complex tools offered by other companies.

- The positive user experience with Geico’s calculator often leads to higher customer satisfaction and loyalty to the brand.

Tips for Using Geico Car Insurance Quote Calculator

When using the Geico Car Insurance Quote Calculator, there are several tips and best practices to keep in mind to maximize the accuracy of the quotes and potentially lower insurance costs.

Provide Accurate Information

It is crucial to input accurate information about your driving history, vehicle details, and coverage preferences. Any discrepancies could lead to inaccurate quotes.

Hey there! Ready to say “Hello world!” to the digital universe? Well, you’re in luck because I’ve got just the link for you: Hello world!. Click on it and discover a whole new world of possibilities waiting for you!

Adjust Coverage Levels

Consider adjusting the coverage levels to see how it impacts the quotes. You can increase or decrease coverage limits, deductibles, and add-ons to find a balance between the price and protection offered.

Explore Discounts

Take advantage of any available discounts by selecting the ones that apply to you. Geico offers various discounts based on factors like safe driving, vehicle safety features, and bundling policies.

Compare Quote Options

After receiving quotes, compare different options to see how adjusting variables affects the premiums. You can customize the coverage and compare prices to find the best value for your insurance needs.

Hey there, ready to conquer the digital world? Let’s start by saying Hello world! and dive into the exciting realm of coding. Whether you’re a newbie or a seasoned pro, this classic phrase marks the beginning of an epic journey full of endless possibilities.

So, embrace the challenge, unleash your creativity, and get ready to make your mark in the tech-savvy universe!

Review and Revise, Geico car insurance quote calculator

Review the details of the quotes carefully and revise any information if necessary. Small changes in variables can lead to significant differences in premiums, so it’s essential to double-check before finalizing your decision.

Wrap-Up

In a nutshell, Geico’s car insurance quote calculator is your key to unlocking the best insurance rates tailored to your needs. Say goodbye to guesswork and hello to precision in securing the right coverage at the right price.

FAQ Summary: Geico Car Insurance Quote Calculator

Can I use the Geico car insurance quote calculator for multiple vehicles?

Yes, you can input details for multiple vehicles to get accurate quotes for each one.

Is the Geico car insurance quote calculator free to use?

Yes, the calculator is a free tool provided by Geico to help users estimate their insurance costs.

How often should I use the Geico car insurance quote calculator to update my quotes?

It’s recommended to use the calculator annually or whenever there are significant changes in your driving profile or vehicles.