Farmers car insurance quote comparison for SUVs takes center stage in the quest for the best coverage. Buckle up as we dive into the world of SUV insurance quotes with a twist of excitement and valuable insights.

Are you ready to rev up your knowledge about Farmers car insurance for SUVs? Let’s hit the road and explore the ins and outs of finding the perfect coverage for your SUV.

Introduction to Farmers Car Insurance Quote Comparison for SUVs

Farmers car insurance is a well-known insurance provider that offers coverage for a wide range of vehicles, including SUVs. When it comes to insuring your SUV, it is essential to compare quotes from different insurance companies to ensure you get the best coverage at the most competitive rates.

Comparing quotes for SUVs can help you find the most suitable policy that meets your needs and budget. By obtaining quotes from Farmers car insurance, you can evaluate the coverage options, premiums, and discounts available for your SUV.

Overview of the Process of Obtaining Insurance Quotes

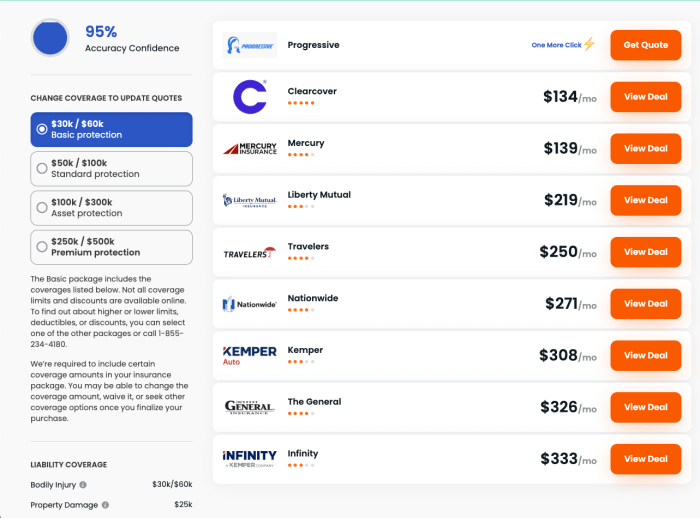

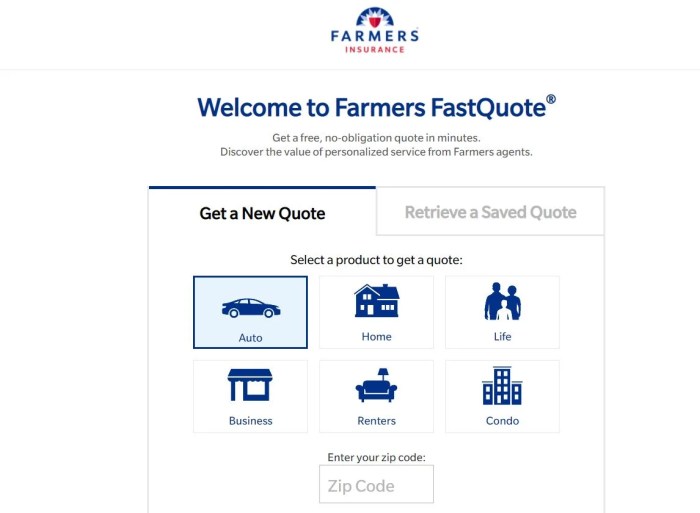

When seeking insurance quotes for your SUV from Farmers, you can start by visiting their website or contacting a local agent. You will need to provide details about your vehicle, driving history, and coverage preferences to receive personalized quotes.

- Fill out an online form with information about your SUV, such as make, model, year, and mileage.

- Specify the coverage limits and deductibles you desire to tailor the quote to your needs.

- Review the quotes provided by Farmers to compare coverage options, premiums, and discounts.

- Contact a Farmers agent to discuss the quotes in detail and finalize the policy for your SUV.

Factors to Consider When Comparing Farmers Car Insurance Quotes for SUVs

When comparing Farmers car insurance quotes for SUVs, there are several key factors to keep in mind to ensure you are getting the best coverage at the most competitive rates.Coverage Options Available for SUVs:SUVs typically require comprehensive coverage due to their higher value and increased risk of accidents.

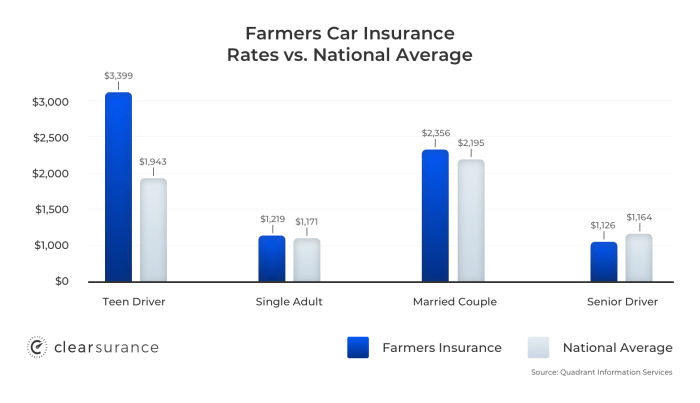

Farmers offers a range of coverage options for SUVs, including liability, collision, comprehensive, uninsured/underinsured motorist, and personal injury protection.How the Type of SUV Can Impact Insurance Rates:The type of SUV you drive can significantly impact your insurance rates. Factors such as the vehicle’s make and model, safety features, age, and usage can all influence the cost of insurance.

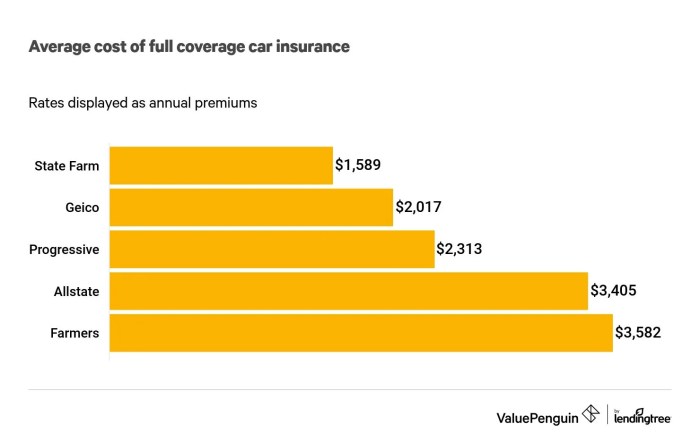

For example, a luxury SUV may have higher insurance rates compared to a standard SUV due to its higher repair costs.Comparing Pricing Structure of Farmers Car Insurance for SUVs with Other Providers:When comparing Farmers car insurance rates for SUVs with other providers, it’s essential to consider the overall value you are receiving.

Are you looking for a quick and easy way to get a Geico car insurance quote calculator ? Look no further! With just a few clicks, you can find out how much you could save on your car insurance. Don’t waste any more time, give it a try now!

While Farmers may offer competitive rates, it’s crucial to compare coverage limits, deductibles, discounts, and customer service reputation to ensure you are getting the best deal for your specific SUV insurance needs.

Steps to Compare Farmers Car Insurance Quotes for SUVs: Farmers Car Insurance Quote Comparison For SUVs

When comparing Farmers car insurance quotes for SUVs, there are specific steps you can take to ensure you are making an informed decision. From requesting quotes to reviewing policy details, each step plays a crucial role in helping you choose the right insurance coverage for your SUV.

Requesting Quotes from Farmers

- Visit the Farmers website or contact a local agent to request car insurance quotes for your SUV.

- Provide accurate information about your SUV, driving history, and coverage needs to receive personalized quotes.

- Compare quotes from different Farmers insurance plans to understand the coverage options and pricing available for your SUV.

Comparing Different Quotes Effectively, Farmers car insurance quote comparison for SUVs

- Look beyond the premium cost and consider the coverage limits, deductibles, and additional benefits offered by each quote.

- Evaluate the reputation of Farmers, customer reviews, and claims process to gauge the quality of service provided.

- Consider any discounts or special offers available that could help you save on your car insurance premium.

Reviewing Policy Details Before Making a Decision

- Thoroughly review the policy details of each quote to understand what is covered and excluded in the insurance plan.

- Ask questions about any terms or conditions that are unclear to ensure you fully comprehend the coverage provided.

- Compare the customer service options, ease of claims filing, and responsiveness of Farmers when choosing an insurance plan for your SUV.

Benefits of Choosing Farmers Car Insurance for SUVs

When it comes to insuring your SUV, Farmers Car Insurance offers a range of benefits that cater specifically to SUV owners. From unique features to discounts and exceptional customer service, Farmers is a top choice for SUV insurance coverage.

Unique Features and Discounts

- Farmers offers specialized coverage options for SUVs, including comprehensive and collision coverage tailored to the needs of larger vehicles.

- Discounts are available for SUV owners who have safety features installed in their vehicles, such as anti-theft devices, backup cameras, and adaptive cruise control.

- Multi-policy discounts are also offered for customers who insure both their SUV and another vehicle or property with Farmers.

Customer Service Reputation

- Farmers has a reputation for providing excellent customer service, with a dedicated team of agents ready to assist SUV owners with their insurance needs.

- Claims processing is efficient and hassle-free, ensuring that SUV owners can get back on the road quickly after an accident or other covered incident.

Testimonials from SUV Owners

“I’ve been a Farmers customer for years, and their coverage for my SUV has been exceptional. The discounts I receive for safety features make me feel confident on the road.”

Sarah, SUV Owner

Are you looking for a quick and easy way to get a Geico car insurance quote? Look no further! With the Geico car insurance quote calculator , you can get an estimate in just a few minutes. Simply input your information, and the calculator will provide you with a personalized quote tailored to your needs.

It’s fast, convenient, and hassle-free!

“After a minor fender bender, Farmers handled my claim with professionalism and speed. I was impressed by how quickly they resolved the issue and got me back on the road.”

Michael, SUV Owner

End of Discussion

As we park our discussion on Farmers car insurance for SUVs, remember to steer towards the best deal by comparing quotes wisely. Safeguard your SUV with the right coverage and hit the road with confidence!

Q&A

What makes Farmers car insurance stand out for SUVs?

Farmers offers unique discounts and features tailored for SUV owners, providing specialized coverage.

How can the type of SUV affect insurance rates with Farmers?

The cost of insurance can vary based on factors like the SUV model, age, safety features, and usage.

Is it important to review policy details before choosing Farmers car insurance for an SUV?

Absolutely! Understanding the policy terms ensures you select the right coverage that meets your needs.